A Vision for Stablecoins Beyond Centralization

In the ever-evolving world of decentralized finance (DeFi), stablecoins remain one of the most debated and impactful innovations. They serve as the bridge between traditional value and on-chain liquidity, yet their design and governance have long sparked disagreement. Ethereum co-founder Vitalik Buterin has been one of the most thoughtful voices on the subject, advocating for decentralized stablecoins that align with the ethos of permissionless, transparent, and community-driven finance.

Vitalik’s perspective is rooted not merely in ideology, but in practical concerns that have emerged as DeFi matures. From pegging mechanisms to systemic risk, his reflections point to a future in which stablecoins are not controlled by any single entity and where robustness is baked into the protocol rather than imposed from above.

Why Decentralization Matters for Stablecoins

Traditional stablecoins, those issued and backed by centralized custodians with fiat reserves, have played a vital role in bootstrapping crypto markets. Yet their reliance on trust in institutions runs counter to the fundamental promise of decentralized systems. Centralized stablecoins carry counterparty risk: if reserve attestations falter, or if a custodian becomes insolvent, holders can find themselves exposed regardless of on-chain balances.

Vitalik argues that truly decentralized stablecoins, ideally native to blockchain ecosystems such as Ethereum, circumvent this exposure by distributing risk across participants, smart contracts, and economic incentives. Instead of trusting a corporate balance sheet, users trust code and economic design, a model that resonates with DeFi’s broader goal of minimizing reliance on centralized intermediaries.

This sentiment doesn’t dismiss the value of centralized stablecoins entirely. Rather, it highlights a philosophical pivot: as DeFi matures, stablecoin designs should reflect resilience, composability, and decentralization without compromising on price stability.

Models of Decentralized Stablecoins

Vitalik has explored several architectures for decentralized stablecoins over time. Among them are overcollateralized models, algorithmic peg mechanisms, and hybrid designs that leverage on-chain assets to maintain stability.

Overcollateralized systems, where users lock crypto assets exceeding the pegged value of issued stablecoins, are already in use in prominent DeFi protocols. These systems provide transparency and lower reliance on off-chain assets, but they can suffer from capital inefficiency and susceptibility to volatility during sharp market moves.

Algorithmic approaches, which automatically adjust supply and demand through protocols, aim to reduce reliance on collateral but can face challenges in maintaining pegs under stress. Hybrid models seek a middle ground, mixing decentralization with pragmatic stability mechanisms.

Vitalik’s viewpoint suggests that rather than searching for a single perfect model, the community might embrace modular frameworks where stability mechanisms, governance structures, and collateral systems coexist in composable layers. This approach reflects DeFi’s strength: interoperability among protocols that can learn from each other and evolve.

Risk, Governance and Community Trust

A recurring theme in Vitalik’s remarks is the importance of governance and risk controls. Decentralized stablecoins require robust governance systems that balance responsiveness with safety. Too much centralization in governance undermines the decentralized philosophy; too little can lead to paralysis or exploitation.

Vitalik has highlighted the value of community-centric governance constructs that leverage broad participation and transparent decision-making. This can include decentralized autonomous organizations (DAOs), multi-party risk committees, and on-chain parameters that adjust according to predefined conditions.

From a risk perspective, decentralized stablecoins must anticipate not only price volatility but also systemic shocks, liquidity dry-ups, and composability spillovers, where stress in one protocol cascades through interconnected systems. Designing stablecoins for composability means understanding how they interact with lending markets, liquidity pools, synthetic assets, and credit systems across blockchains.

In this context, decentralized stablecoin design isn’t merely a technical exercise. It’s an ecosystem strategy that must consider macro risk, governance safeguards, and the very mechanisms that enable DeFi to function.

What This Means for DeFi’s Future

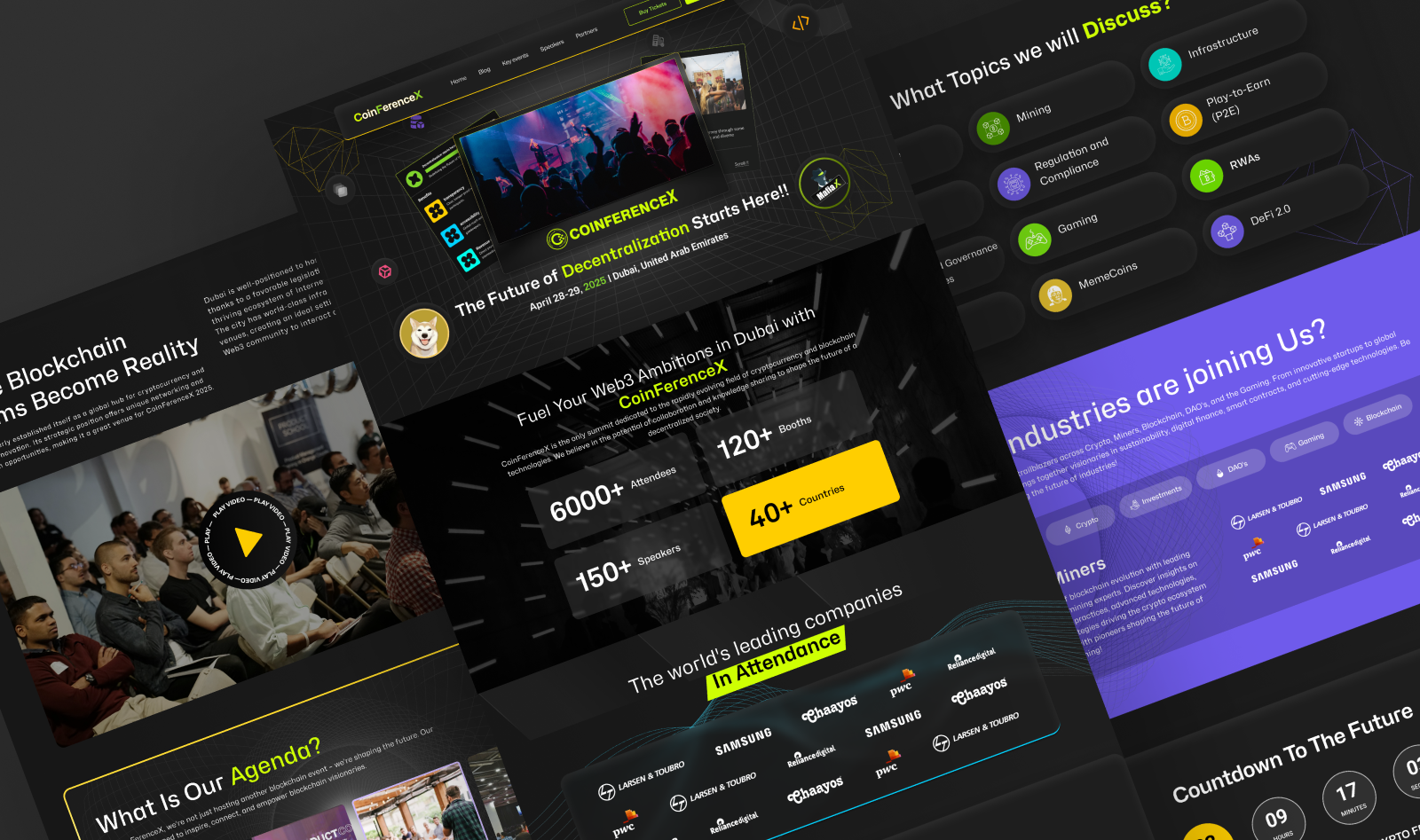

Vitalik’s vision for decentralized stablecoins fits into a larger narrative about DeFi’s second era, one where innovation is tempered with pragmatism and resilience. As DeFi expands beyond early adopters to attract institutional engagement and mainstream users, the underlying tools, including stablecoins, must inspire confidence without sacrificing decentralization.

This means prioritizing protocols that minimize hidden risks, align incentives among stakeholders, and facilitate open participation. It also means questioning models that centralize control under the guise of short-term stability and instead exploring designs that can withstand stress without single points of failure.

A decentralized stablecoin ecosystem could encourage greater competition, deepen liquidity, and reduce systemic risk by distributing influence across network participants rather than a handful of custodians. It also strengthens the foundational plumbing of DeFi, where trust is algorithmic and participation is permissionless.

In such a landscape, stablecoins become not just instruments of convenience but pillars of decentralized financial infrastructure tools that enable lending, trading, savings, yield strategies, and cross-chain interactions with minimal reliance on centralized intermediaries.

Challenges and the Road Ahead

- Despite the promise of decentralized stablecoin designs, challenges remain. Ensuring regulatory clarity, protecting users from emergent vulnerabilities, and achieving broad adoption are monumental tasks. Regulators around the world are still defining how stablecoins fit into financial systems, and the responses vary widely by jurisdiction, posing uncertainty for builders and adopters alike.

Additionally, decentralized designs often require significant capital commitments and complex governance frameworks, which can slow development and introduce new layers of coordination risk. For some participants, the simplicity and familiarity of centralized stablecoins may continue to hold appeal, particularly in regions where regulatory frameworks are behind or ambiguous.

Yet the central lesson from Vitalik’s perspective is that decentralization shouldn’t be sacrificed for convenience. Instead, the community should invest in iterative, composable, safe mechanisms that fulfill the promise of permissionless finance, putting users and shared governance at the center.